This strategy uses the EMA signal to look at market momentum combined with RSI to protect against buying when the asset is potentially "overbought".

Disclaimer: These strategies should not be considered financial advice and in no way guarantee results. You should understand these settings and how they impact trading before using them.

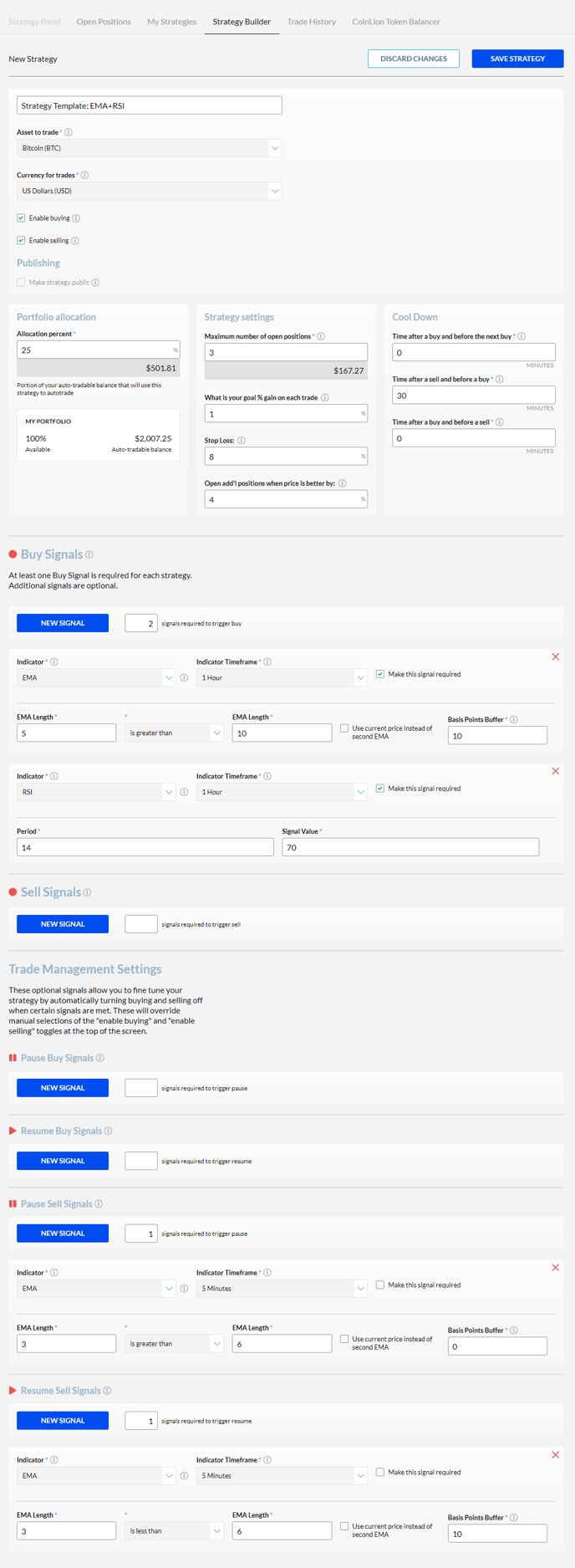

Step 1:

Go to Auto Trader > Strategy Builder. This will give your a blank strategy to start building. Once there:

- Name your strategy

- Pick the asset to trade

- Pick the base currency for trades

- Make sure "enable buying" and "enable selling" are selected if you want this to start looking for trades as soon as you "save strategy" in the upper right.

Step 2:

Next we will set our Portfolio Allocation, overall Strategy Settings, and Cool Downs.

Portfolio Allocation, overall Strategy Settings, and Cool Downs

- Portfolio Allocation: 25%

- Maximum number of open positions: 3

- What is your goal % gain on each trade: 0.5%

- Stop Loss: 8%

- Open add'l positions when price is better by: 4%

- Time after a buy and before the next buy: 0 min

- Time after a sell and before a buy: 30 min

- Time after a buy and before a sell: 0 min

Step 3:

Now let's set up the buy signals. This is the logic the platform will look at when deciding whether or not it should open (buy) a new position. In this example, we'll use two signals where both are required to be true before a buy happens.

The first Buy Signal we'll set is for when the 5 EMA is greater than the 10 EMA. This simply means the momentum of the previous 5 candles is greater than the momentum of the previous 10 candles.

Let's add that buy signal to CoinLion. Under the Buy Signals section, click:

1. Buy Signal: EMA

- New Signal: EMA

- Indicator Timeframe: 1 Hour

- EMA Length 5 "is greater than" EMA Length 10

- Basis Points Buffer = 10

- Make this signal required

Here's an example of when that'd trigger based on charts; the blue line is the 5 EMA and the white line is the 10 EMA. Since the 5 (blue) is now greater than the 10 (white), the system should trigger a buy.

Keep in mind that EMAs don't only trigger when the EMAs cross, but could also trigger later while the 5 is still greater than the 10. This is where the "Open add'l positions when price is better by" field comes in handy, as it will only open another position if the price is better (lower) than your existing open positions.

Source: TradingView.com

Step 4:

In this example, we're going to add a second buy signal where both the EMA we added above and this signal are required to be true for it to trigger.

To add some protection from bad buys let's add this RSI signal as required:

2. Buy Signal: RSI

- New Signal: RSI

- Indicator Timeframe: 1 Hour

- Period = 14

- Signal Value = 70

- Make this signal required

Setting the RSI at 70 in a buy signal means the RSI has to be below 70 for it to trigger. Since most traders typically don't want to buy an overbought asset, making sure the RSI is at least below 70 will help to avoid that. You can be even more conservative by putting in a lower number.

Step 5:

Since we set a "What is your goal % gain on each trade" of 1% in this strategy, we will skip Sell Signals. This strategy simply wants to make sure your gain is at least 1%.

If you didn't set a % gain goal, another approach could be to set a sell signal for when the 5 EMA is now less than the 10 EMA, basically doing the reverse of your buy signal. If you use a sell signal, the "What is your goal % gain on each trade" field is ignored.

We're also going to skip Pause and Resume Buy signals and go straight to Pause and Resume Sell signals. This is what allows you to take a larger gain than 1% when the market is moving up fast.

Pause Sell Signals

- New Signal: EMA

- Indicator Timeframe: 5 Minutes

- EMA Length 3 "is greater than" EMA Length 6

- Basis Points Buffer = 0

This will turn selling off while the market is moving up fast, which allows the system to wait past your 1% profit goal. Because we're looking at 5 minute candles, the system can see if there's momentum moving upward and fast.

Resume Sell Signals

- New Signal: EMA

- Indicator Timeframe: 5 Minutes

- EMA Length 3 "is less than" EMA Length 6

- Basis Points Buffer = 10

Step 7:

Last step is to scroll to the top and click "Save Strategy".

That's it! You've created an automated trading strategy on CoinLion.

A few final tips:

You can always edit or delete this strategy from the "My Strategies" screen.

Even if you turn on/off buying or selling from the My Strategies screen, it could turn back or off automatically if you're using the pause and resume buy/sell signals.

You can also copy a strategy to use as a starting point to build off of. Maybe you want to use all the same settings, except do 15 minute candles instead of 1 hour, or you want to remove the Stop Loss.

![]() Delete Strategy

Delete Strategy![]() Edit Strategy

Edit Strategy![]() Copy Strategy

Copy Strategy

You now have complete control of your automated trading. Happy trading!

Full view of settings: